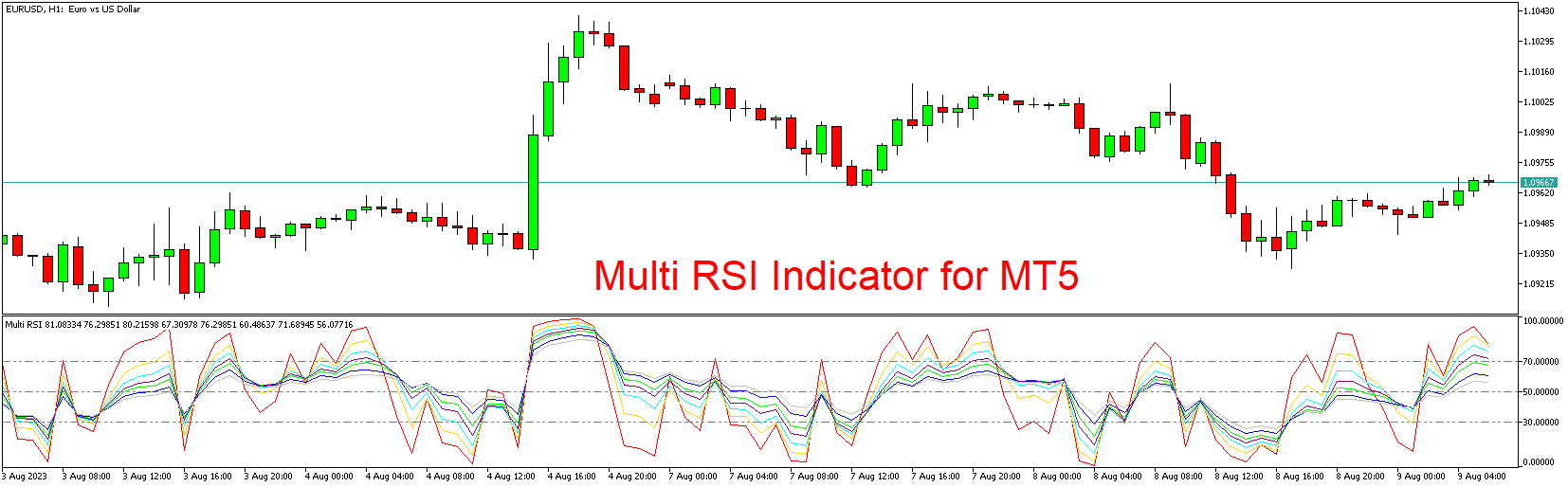

In the dynamic world of financial trading, having access to versatile and insightful technical indicators is essential for making informed decisions. Among the plethora of indicators available, the Multi RSI Indicator for MT5 stands out as a powerful tool that provides traders with a comprehensive view of market momentum and potential trend reversals. In this article, we will delve into the key features and benefits of the Multi RSI Indicator, guide you through the process of downloading and installing it on your MetaTrader 5 platform, and explore how it can enhance your trading strategy.

Introduction

The Multi RSI Indicator is designed to offer a deeper understanding of market conditions by providing insights into multiple Relative Strength Index (RSI) indicators simultaneously. The RSI is a popular momentum oscillator that measures the speed and change of price movements. By aggregating multiple RSI indicators, traders can gain a more comprehensive perspective on market trends and potential turning points.

Key Features of the Multi RSI Indicator

- Multi-Timeframe Analysis: The indicator allows you to apply multiple RSI indicators across different timeframes on a single chart. This feature enables you to identify trends and momentum shifts across various time horizons.

- Customizable Parameters: Traders can adjust the parameters of each RSI indicator, such as the period and overbought/oversold levels, to align with their trading strategy and preferences.

- Visual Clarity: The Multi RSI Indicator uses different colors or line styles for each RSI line, making it easy to distinguish between them and interpret their signals.

Key Benefits of the Multi RSI Indicator

- Comprehensive Analysis: By aggregating multiple RSI indicators, traders can obtain a more comprehensive and well-rounded analysis of market trends and potential reversals.

- Confirmation of Signals: When multiple RSI indicators across different timeframes generate similar signals, it can provide stronger confirmation for potential entry or exit points.

- Enhanced Timing: The Multi RSI Indicator helps traders fine-tune their timing by identifying potential turning points more accurately, leading to improved trade execution.

How to Download and Install the Multi RSI Indicator

Integrating the Multi RSI Indicator into your MetaTrader 5 trading platform is a straightforward process. Here’s a step-by-step guide:

- Download the Indicator: Locate a reputable source that offers the Multi RSI Indicator for free download. Save the indicator file (usually in “.ex5” format) to your computer.

- Access the Indicator Folder: Open your MetaTrader 5 platform and navigate to the “File” menu. Select “Open Data Folder,” which will open the directory containing your platform’s files.

- Install the Indicator: Within the data folder, find the “MQL5” directory, then go to the “Indicators” subfolder. Copy and paste the downloaded indicator file into this folder.

- Restart MT5: Close and reopen your MetaTrader 5 platform to ensure that the Multi RSI Indicator is properly loaded.

- Apply the Indicator: Open a price chart of your preferred trading instrument. Right-click on the chart, select “Indicators List,” and choose the Multi RSI Indicator from the list.

- Configure Settings: A settings window will appear, allowing you to customize the parameters of the indicator. Adjust the settings according to your trading strategy and preferences, then click “OK” to apply the changes.

Conclusion

The Multi RSI Indicator for MT5 is a powerful tool that empowers traders with a comprehensive view of market momentum and potential trend reversals. By aggregating multiple RSI indicators across different timeframes, this indicator provides deeper insights and confirmation for trading decisions. As with any technical tool, it is recommended to use the Multi RSI Indicator in conjunction with other forms of analysis and risk management techniques.

Download indicator