Introduction

The doji arrows indicator is one of the most popular technical analysis tools on MT4. It’s used to forecast price volatility and predict future movements in an asset’s price, but how does it work? What are these so-called “doji” indicators? And why do they matter? In this article, we’ll look at what these terms mean and how they can be used in your trading strategy.

What is doji indicator MT4?

A doji is a candlestick pattern that occurs when the open and close of the trading day are equal in value, with no real direction. Doji indicators are used to identify indecision in markets and can be used as an indicator of market volatility.

The doji may appear as either black or white candles on your chart, with the former being more common among traders who prefer candlestick charts over bar charts. Like other types of indicators (for example, Bollinger Bands), there are plenty of different ways you can use this information—but here’s just one: when it comes up on your charts (usually near major support/resistance levels), these signals indicate an area where buyers or sellers have been waiting for an opportunity to make their move forward with little resistance between them so far; this could mean big price movement down after being stagnant for awhile!

Doji’s and the Kijun-sen Line

The Kijun-Sen Line is the average of the high and low prices. It’s a candlestick that has a small body, long upper and lower shadows, which indicates indecision in the market. This can be seen as a signal for further price movement either up or down in your favor. Doji’s show lack of any real bearish or bullish momentum; they occur when there isn’t enough interest to drive prices strongly either way (i.e., no one wants them).

Doji as an indicator of price volatility

Doji’s are a sign of market indecision. They can be used to predict market movement and reversals in direction, as well as trend changes.

Doji’s are indicated by a price that is above the previous day’s high but below its previous day’s low and takes place over an extended period of time (usually at least two days).

How does the Doji Arrows Indicator for MT4 Work?

The Doji Arrows Indicator for MT4 is a very useful tool to help you determine whether or not to enter a trade. The indicator uses the doji as an entry signal, confirmation signal, and stops loss signal. It also uses them as take-profit signals and trend reversal signals.

The Doji Arrows Indicator was developed by one of our colleagues at the TradingView community forum who happens to be one of our favorite traders on there! He has been using this indicator since 2012 when it first came out and he has never looked back since then!

Trading with the doji indicator

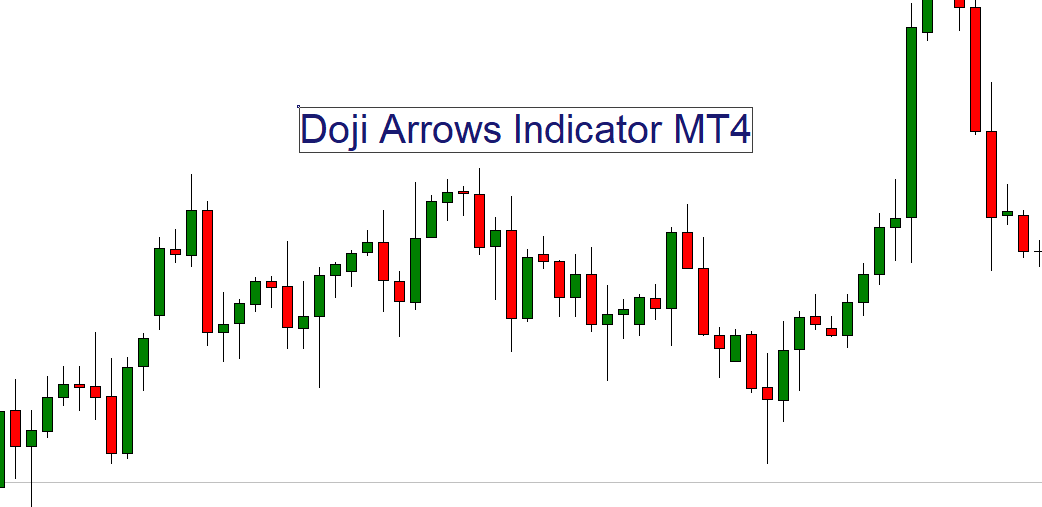

The doji indicator is a combination of other technical analysis tools and it can be used to predict market movement. The doji arrow in the chart below shows that the price of the stock has been moving up and down, but not too much, for some time now.

The indicator pattern appears when there are no big changes in either direction (uptrend or downtrend). This happens because traders have become tired from seeing such movements and they decide not to buy or sell anything until they see some signs indicating a change in trend direction.

Doji arrows are formed when there are no major shifts between two separate periods of trading activity. Traders then wait until these periods end before making any new purchases or sales decisions based on their own observations about what happens next with regards to price movements on an ongoing basis throughout each day’s trading session.”

How the Doji Arrows Indicator for MT4 Works?

The doji indicator is a technical tool that can be used to predict market movement. It is based on the theory of candlesticks, which was developed by Japanese trader Hasegawa Satoshi in 1834. The doji indicator assumes that all prices within an instrument have reached their limits and there is no more support or resistance level for that particular instrument.

The main purpose behind this assumption is to identify reversal points in price movements before they actually happen. Traders who use this type of indicator may want to wait until after these reversal points before entering trades or closing out existing positions because they will know whether their entry point was correct at least this far into their trade strategy.

Conclusion

The doji indicator can be useful for traders who want to predict market movement. For example, if you know that the price of a particular asset will move up on a certain day or week, then you should use the doji signal and wait for it to confirm your expectations.

Download