Introduction

The Spearman Rank Auto Correlation Indicator for MT5 is a powerful tool that helps traders identify and analyze the correlation between different financial instruments. It utilizes the Spearman Rank Correlation coefficient to measure the statistical relationship between two variables and provides valuable insights into market dynamics. In this article, we will explore the features, functionality, and benefits of the Spearman Rank Auto Correlation Indicator for MT5 and provide a free download link for traders to access this useful tool.

Features of the Spearman Rank Auto Correlation Indicator

The Spearman Rank Auto Correlation Indicator offers several key features that make it an indispensable tool for correlation analysis:

- Correlation Calculation: The indicator calculates the Spearman Rank Correlation coefficient between two financial instruments. This coefficient measures the strength and direction of the relationship between the variables, providing valuable information about their correlation.

- Customizable Periods: Traders can customize the calculation period of the indicator to suit their trading preferences. They can adjust the number of periods considered for correlation analysis, allowing them to focus on short-term or long-term correlations.

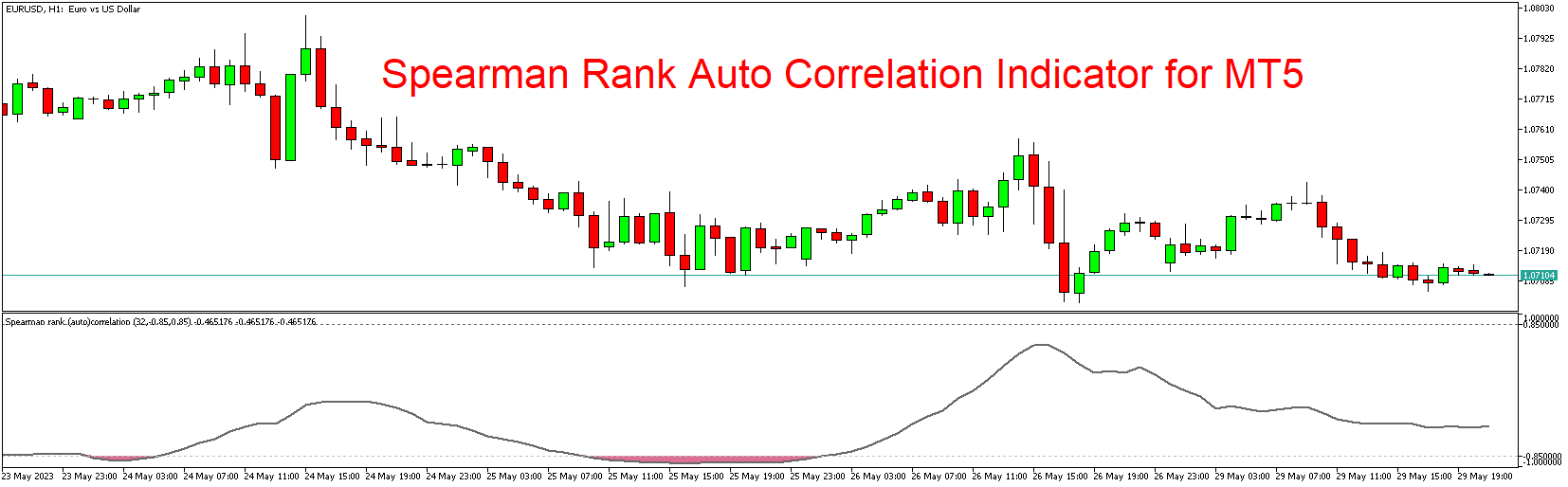

- Visual Representation: The Spearman Rank Auto Correlation Indicator visually displays the correlation coefficient as a line or histogram on the chart. Traders can easily interpret the indicator’s values to assess the strength and direction of the correlation.

- Multiple Pairs Analysis: The indicator allows traders to analyze correlations between multiple pairs simultaneously. This feature is particularly beneficial for portfolio managers and traders who want to understand the interrelationships between various financial instruments.

Functionality of the Spearman Rank Auto Correlation Indicator

The Spearman Rank Auto Correlation Indicator operates based on the following principles:

- Correlation Calculation: The indicator calculates the Spearman Rank Correlation coefficient by comparing the price movements of two financial instruments over a specified period. The coefficient ranges from -1 to +1, with positive values indicating a positive correlation, negative values indicating a negative correlation, and zero indicating no correlation.

- Visualization: The indicator visually represents the correlation coefficient as a line or histogram on the chart. Positive values are displayed in one color, negative values in another color, and zero values in a neutral color. This visual representation helps traders quickly identify and interpret the correlation patterns.

- Trend Identification: By analyzing the correlation coefficient over time, the indicator helps traders identify trends in the correlation between two financial instruments. This information can be useful for identifying opportunities for pairs trading or adjusting portfolio allocations.

- Customization: Traders have the flexibility to customize the indicator’s parameters, such as the calculation period and visual display options. This customization allows traders to adapt the indicator to their specific trading strategies and preferences.

Benefits of the Spearman Rank Auto Correlation Indicator

- Correlation Analysis: The Spearman Rank Auto Correlation Indicator provides a systematic approach to analyzing the correlation between financial instruments. Traders can gain insights into the relationship between different assets, which can be valuable for portfolio diversification and risk management.

- Trading Opportunities: By identifying strong correlations, traders can spot trading opportunities. Positive correlations can help traders identify pairs for pairs trading strategies, while negative correlations can be useful for hedging or spread trading strategies.

- Risk Management: Understanding correlations between different assets is crucial for effective risk management. The indicator helps traders identify assets that move together or in opposite directions, allowing them to adjust their positions and manage portfolio risk effectively.

- Portfolio Optimization: Portfolio managers can use the Spearman Rank Auto Correlation Indicator to optimize portfolio allocations. By identifying assets with low correlation, portfolio managers can construct well-diversified portfolios that reduce overall risk.

Conclusion

The Spearman Rank Auto Correlation Indicator for MT5 is a powerful tool for correlation analysis, providing traders with valuable insights into the relationships between financial instruments. By understanding the correlation patterns, traders can identify trading opportunities, manage risk, and optimize portfolio allocations. The customizable features and visual representation make it easy to interpret and apply the indicator in real-time trading.

Download the Spearman Rank Auto Correlation Indicator for MT5 today and enhance your trading strategy with the power of correlation analysis. Remember to test the indicator on a demo account before using it in live trading to familiarize yourself with its functionality and ensure it aligns with your trading objectives.

Download indicator