Introduction

The TMA CD Divergence Indicator for MT5 is a powerful technical analysis tool that helps traders identify hidden divergences in the market, providing valuable insights into potential trend reversals and trading opportunities. In this comprehensive guide, we will discuss the definition, workings, optimal settings, and how to trade using the TMA CD Divergence Indicator for MT5 effectively. Additionally, we will provide a conclusion and any other relevant information to help you make the most of this versatile indicator.

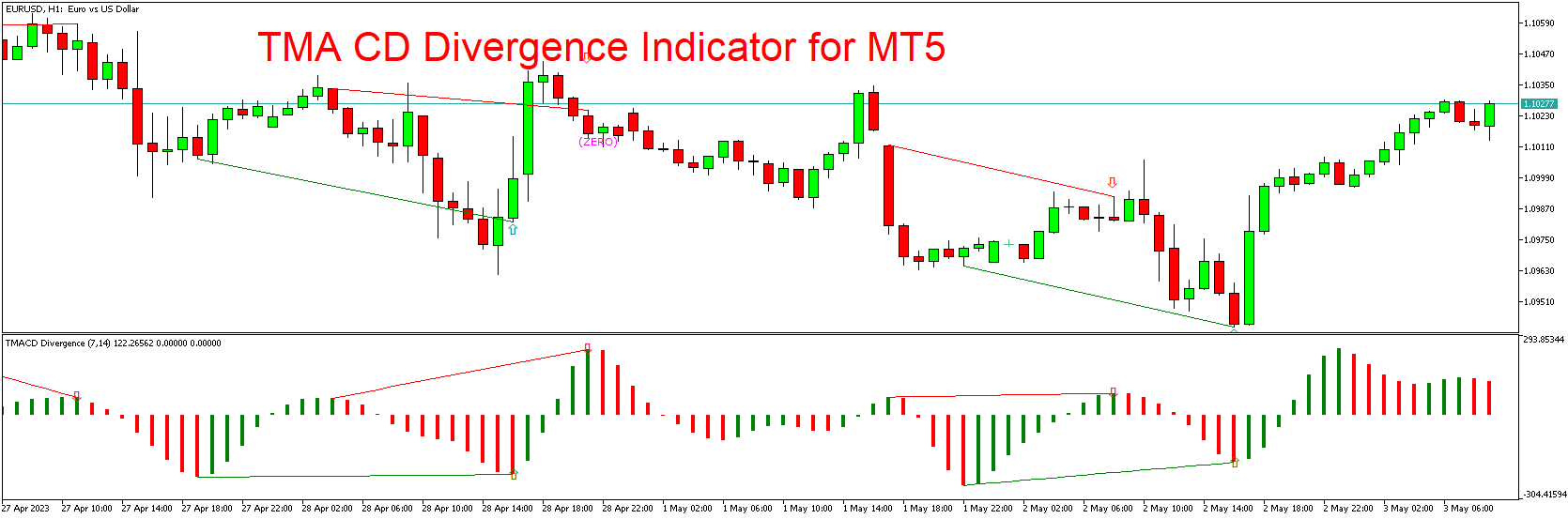

Definition of the TMA CD Divergence Indicator

The TMA CD Divergence Indicator for MT5 is an advanced technical analysis tool designed to identify hidden divergences between price action and the Triangular Moving Average Convergence Divergence (TMA CD) oscillator. These divergences can serve as early warning signs of potential trend reversals, allowing traders to capitalize on market opportunities.

How the TMA CD Divergence Indicator Works

The TMA CD Divergence Indicator combines the strengths of the Triangular Moving Average (TMA) and the Convergence Divergence (CD) principles to create a unique oscillator that tracks price movements. The indicator then compares the oscillator’s highs and lows with the corresponding price action highs and lows to detect hidden divergences. When a divergence is identified, the indicator plots an arrow on the chart, signaling a potential trend reversal.

Optimal Settings for the TMA CD Divergence Indicator

The TMA CD Divergence Indicator for MT5 comes with a default setting that works well for most trading scenarios:

| Setting | Description | Recommended Value |

|---|---|---|

| TMA Period | The period for the Triangular Moving Average calculation. | 14 |

| CD Period | The period for the Convergence Divergence calculation. | 9 |

| Price Type | The price type used in the calculations (e.g., Close, Open, etc.) | Close |

However, traders may adjust the TMA Period, CD Period, and Price Type settings to suit their personal preferences and trading style.

Trading with the TMA CD Divergence Indicator: Buy and Sell Signal Requirements

Here are some tips on how to use the TMA CD Divergence Indicator for trading:

- Bullish divergences: A bullish hidden divergence occurs when the price makes a higher low, while the TMA CD oscillator makes a lower low. This suggests that the underlying trend may be losing momentum, and a reversal to the upside may be imminent. Traders can use these signals as potential entry points for long positions.

- Bearish divergences: A bearish hidden divergence occurs when the price makes a lower high, while the TMA CD oscillator makes a higher high. This indicates that the underlying trend may be losing strength, and a reversal to the downside may be forthcoming. Traders can use these signals as potential entry points for short positions.

- Combine with other indicators: The TMA CD Divergence Indicator works best when combined with other technical analysis tools, such as trendlines, moving averages, or support and resistance levels. By incorporating multiple tools in your trading strategy, you can filter out false signals and improve the overall accuracy of your trades.

- Risk management: As with any trading strategy, it is essential to practice sound risk management when trading with the TMA CD Divergence Indicator. This includes setting appropriate stop-loss levels, using proper position sizing, and adhering to a well-defined trading plan.

Conclusion

The TMA CD Divergence Indicator for MT5 is a powerful and versatile tool that helps traders identify hidden divergences in the market, providing valuable insights into potential trend reversals and trading opportunities. By combining the strengths of the Triangular Moving Average and Convergence Divergence principles, this advanced technical analysis tool allows traders to capitalize on market opportunities more effectively.

Download indicator