Introduction

The Delta Indicator is a powerful technical analysis tool designed to help traders analyze order flow and identify potential market reversals. This insightful MetaTrader 5 (MT5) indicator offers valuable information about the market’s buying and selling pressure, allowing traders to make more informed decisions and adapt their trading strategies accordingly. In this comprehensive guide, we will discuss the Delta Indicator’s concept, its workings, interpretation, and effective trading strategies. Plus, we’ll provide a FREE DOWNLOAD for the MT5 platform.

What is the Delta Indicator?

The Delta Indicator is an MT5 technical analysis tool that helps traders analyze order flow by measuring the difference between buying and selling pressure. The indicator calculates the net difference between the number of contracts bought and sold at each price level, providing a visual representation of the balance between buyers and sellers.

How Does the Delta Indicator Work?

The Delta Indicator works by calculating the net difference between the number of contracts bought and sold at each price level, resulting in a value known as the “delta.” The delta value provides an insight into the buying and selling pressure in the market, allowing traders to identify potential market reversals and areas of interest.

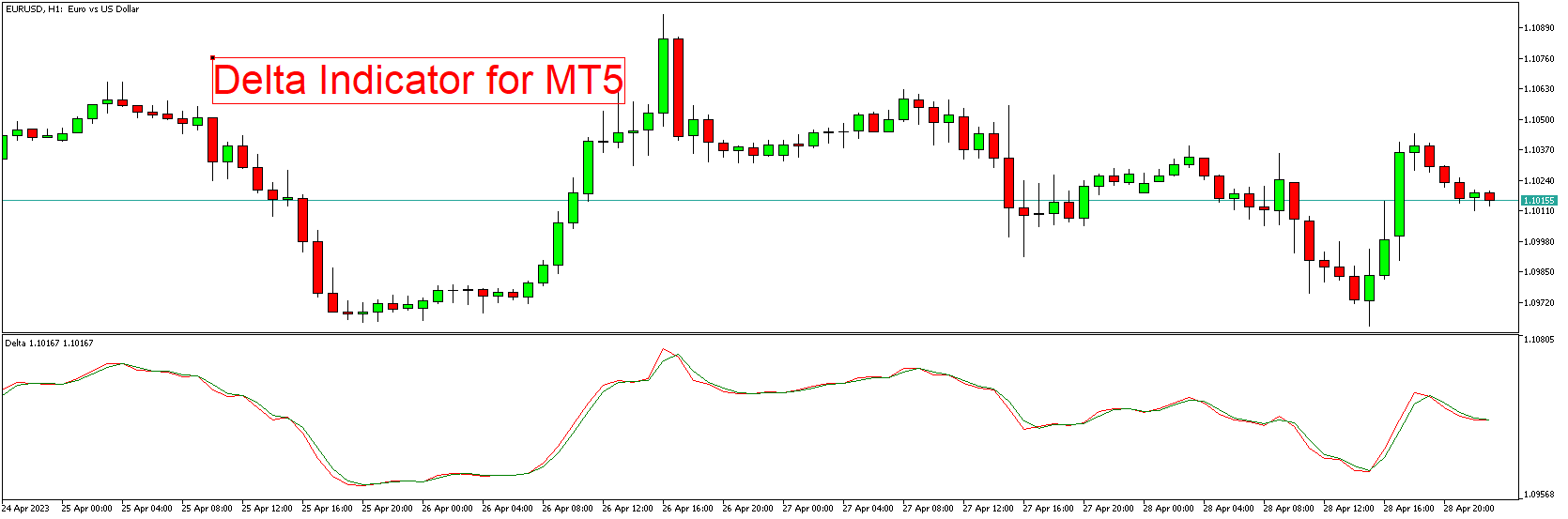

Traders can customize the indicator’s settings, such as the period length for the delta calculation, to suit their trading style and preferences. Once configured, the indicator will display a histogram on the chart representing the delta values, allowing traders to quickly assess the balance between buyers and sellers.

Interpreting the Delta Indicator

The Delta Indicator provides valuable insights into the market’s buying and selling pressure, allowing traders to make more informed decisions and adapt their trading strategies accordingly. Here’s how to interpret the indicator:

- Positive Delta: A positive delta value indicates that buying pressure is dominating, suggesting a potential continuation of the current uptrend.

- Negative Delta: A negative delta value indicates that selling pressure is dominating, suggesting a potential continuation of the current downtrend.

- Delta Divergence: When the price is moving in one direction, but the delta is moving in the opposite direction, it may signal a potential market reversal.

Delta Indicator Trading Strategies

Trading with Market Reversals

Traders can use the Delta Indicator to identify potential market reversals by monitoring for divergences between the price and the delta values. For example, if the price is making higher highs but the delta values are making lower highs, it may indicate a potential bearish reversal.

Combining the Delta Indicator with Other Indicators

For enhanced reliability, traders can use the Delta Indicator alongside other technical analysis tools, such as moving averages, oscillators, or support and resistance levels. By combining these insights with their existing trading strategies, traders can improve their overall trading performance.

Trading with Support and Resistance Levels

Traders can also use the Delta Indicator to identify key support and resistance levels where the balance between buyers and sellers shifts. By monitoring the delta values at these price levels, traders can gauge the strength of the support or resistance and make more informed decisions about entering or exiting trades.

Download indicatorConclusion

The Delta Indicator is a powerful technical analysis tool designed for traders seeking to analyze order flow and identify potential market reversals. By understanding its concept, workings, and interpretation, traders can leverage this MT5 indicator to make more informed decisions and adapt their trading strategies accordingly. Remember to combine the Delta Indicator with other technical analysis tools and fundamental factors to develop a well-rounded trading strategy. Download the FREE Delta Indicator for MT5 to enhance your market analysis experience today.