The Breakout Zone Indicator is a popular tool used by traders to identify potential breakout levels. In this article, we will discuss the features, working, and best settings for the Breakout Zone Indicator on MT5. Additionally, we will provide some tips on how to use this indicator to spot breakout levels and take advantage of them.

Definition

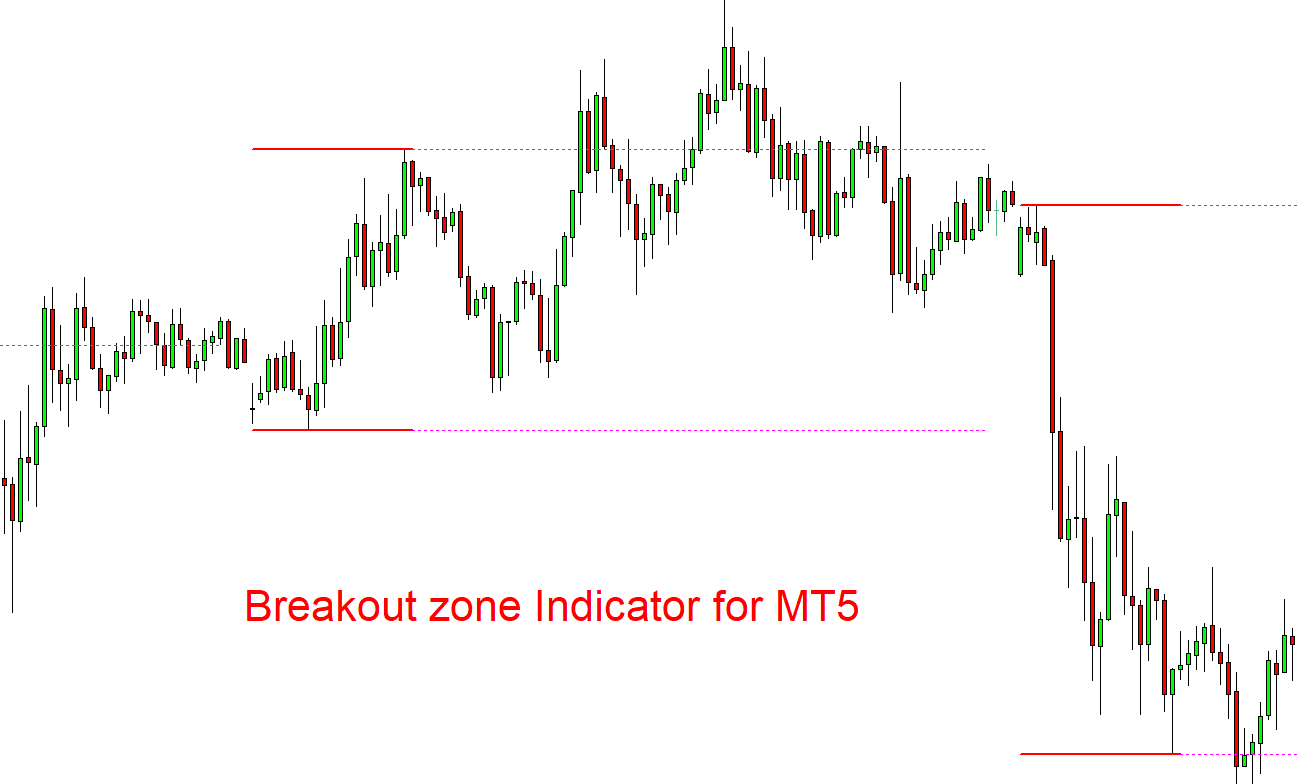

The Breakout Zone Indicator is a technical analysis tool that highlights the areas on a price chart where price is likely to break out of a trading range. It uses a combination of price action, support and resistance levels, and volatility to identify these key breakout zones.

Working of Breakout Zone Indicator in MT5

The Breakout Zone Indicator works by identifying the range-bound market periods and highlighting the areas where price is likely to break out. The indicator uses a combination of moving averages and support and resistance levels to determine the breakout levels. The indicator plots two horizontal lines: the upper line represents the resistance level, while the lower line represents the support level. Once price breaks out of this range, it is likely to continue moving in the same direction.

The best settings for the Breakout Zone Indicator depend on the trader’s preference and the market being traded. However, the default settings of the indicator are 20 for the Moving Average and 2.5 for the ATR. Traders can adjust the ATR period to adjust the sensitivity of the indicator to volatility.

| Settings | Value |

|---|---|

| Moving average period | 20 |

| ATR period | 2.5 |

How to Trade with Breakout Zone Indicator

The Breakout Zone Indicator is a powerful tool for identifying breakout levels. Traders can use this indicator to enter trades in the direction of the breakout, with a stop loss at the opposite side of the breakout zone.

Open a buy trade

Here are the steps for opening a buy trade with the Breakout Zone Indicator:

- Wait for price to break out of the resistance level indicated by the indicator.

- Enter a buy trade with a stop loss at the support level indicated by the indicator.

- Take profit at a predetermined level, or use a trailing stop to capture additional profits.

Open a sell trade

Similarly, here are the steps for opening a sell trade with the Breakout Zone Indicator:

- Wait for price to break out of the support level indicated by the indicator.

- Enter a sell trade with a stop loss at the resistance level indicated by the indicator.

- Take profit at a predetermined level, or use a trailing stop to capture additional profits.

Tips and Tricks

Here are some tips for using the Breakout Zone Indicator effectively:

- Use the indicator in conjunction with other technical analysis tools to confirm potential breakouts.

- Avoid trading in the direction of the breakout until the breakout is confirmed by a strong price move and volume increase.

- Use a trailing stop to capture additional profits during strong trends.

- Consider using the indicator on higher timeframes to filter out the noise and false breakouts.

Conclusion

The Breakout Zone Indicator is a powerful tool for traders to identify key breakout levels. By using this indicator in conjunction with other technical analysis tools, traders can increase their chances of success in trading. With the right settings and trading strategy, the Breakout Zone Indicator can be a valuable addition to any trader’s toolkit.