Introduction

The Volume Weighted Moving Average (VWMA) Indicator is a powerful tool designed for the MetaTrader 5 platform. It incorporates volume data into the calculation of moving averages, providing traders with a more accurate representation of price trends. By considering the volume traded at different price levels, the VWMA indicator helps traders identify significant support and resistance levels and make informed trading decisions. In this article, we will explore the features, working principles, and benefits of the VWMA Indicator for MT5.

Features of the Volume Weighted Moving Average (VWMA) Indicator

The VWMA Indicator offers several features that make it a valuable tool for traders:

- Volume Consideration: Unlike traditional moving averages that only consider price data, the VWMA Indicator incorporates volume data into its calculations. It assigns more weight to periods with higher trading volume, providing a more accurate representation of price trends.

- Dynamic Moving Average: The VWMA Indicator is a dynamic moving average that adjusts its calculation based on the volume-weighted price data. It responds more quickly to changes in market conditions compared to simple moving averages, allowing traders to capture timely trading opportunities.

- Customizable Parameters: Traders can customize the VWMA Indicator’s parameters to suit their trading preferences. They can adjust the period length, which determines the number of bars used in the calculation, and modify other settings to align with their trading strategy.

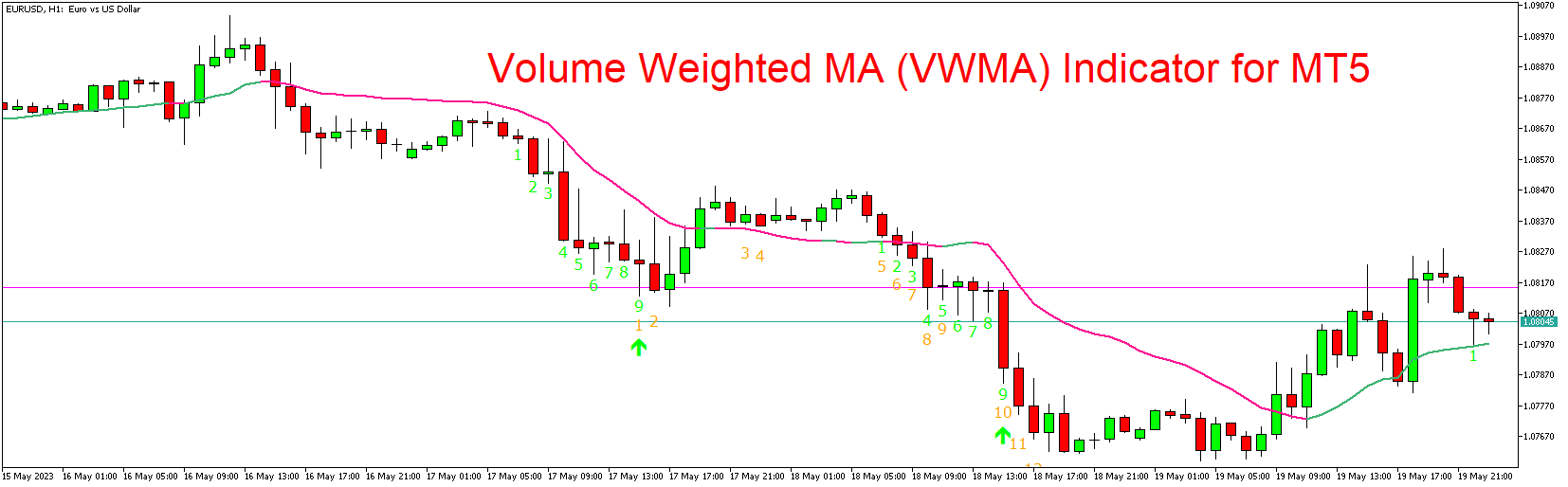

- Visual Representation: The VWMA Indicator is typically displayed as a line chart that overlays the price chart. Traders can easily identify the relationship between price movements, volume, and the VWMA line, facilitating trend analysis and trading decision-making.

Working Principles of the Volume Weighted Moving Average (VWMA) Indicator

The VWMA Indicator calculates the moving average by considering the volume traded at each price level. The indicator’s working principles include the following:

- Price-Volume Calculation: The VWMA Indicator multiplies each price by the corresponding traded volume for a given period. It sums up these volume-weighted prices and divides the sum by the total volume for that period to calculate the VWMA value.

- Weighting Factor: The VWMA assigns more weight to periods with higher trading volume. This means that periods with higher volume contribute more to the calculation of the VWMA, providing a more accurate representation of price trends.

- Moving Average Calculation: The VWMA is typically calculated as a rolling average, where each period’s volume-weighted price is added to the calculation and the oldest period is dropped. This ensures that the VWMA is responsive to recent price and volume data.

- Price-Volume Relationship: The VWMA Indicator helps traders assess the relationship between price movements and volume. Rising VWMA values accompanied by increasing volume may indicate strong buying or selling pressure, while declining VWMA values with decreasing volume may suggest a weakening trend.

Benefits of the Volume Weighted Moving Average (VWMA) Indicator

- Accurate Price Trend Analysis: By incorporating volume data, the VWMA Indicator provides a more accurate representation of price trends. It helps traders identify significant support and resistance levels and detect potential trend reversals.

- Dynamic Trading Signals: The VWMA Indicator’s responsiveness to recent price and volume data allows traders to capture dynamic trading signals. It can generate timely buy or sell signals when the VWMA line crosses the price chart or when the VWMA changes direction.

- Confirmation of Breakouts and Reversals: The VWMA Indicator can confirm breakout and reversal patterns. When price breaks above the VWMA line on high volume, it may signal a bullish breakout. Conversely, when price breaks below the VWMA line on high volume, it may indicate a bearish breakout.

- Volume Analysis: The VWMA Indicator provides insights into trading volume and its impact on price movements. Traders can analyze the relationship between volume and the VWMA line to gauge market participation and the strength of price trends.

Conclusion

The Volume Weighted Moving Average (VWMA) Indicator for MT5 is a valuable tool for traders seeking to analyze price trends with volume consideration. By incorporating volume data into its calculations, the VWMA Indicator provides a more accurate depiction of market dynamics. Its customizable parameters, visual representation, and ability to confirm breakouts and reversals make it a powerful tool for traders. Download the VWMA Indicator for MT5 and explore its features to enhance your trading analysis and decision-making process.

Download indicator