Introduction

The i-Regr Indicator is a powerful technical analysis tool designed to help traders analyze market trends and identify potential trend reversals. This versatile MetaTrader 5 (MT5) indicator provides valuable insights into market conditions, allowing traders to adapt their trading strategies accordingly. In this comprehensive guide, we will discuss the i-Regr Indicator’s concept, workings, interpretation, and effective trading strategies. Plus, we’ll provide a FREE DOWNLOAD for the MT5 platform.

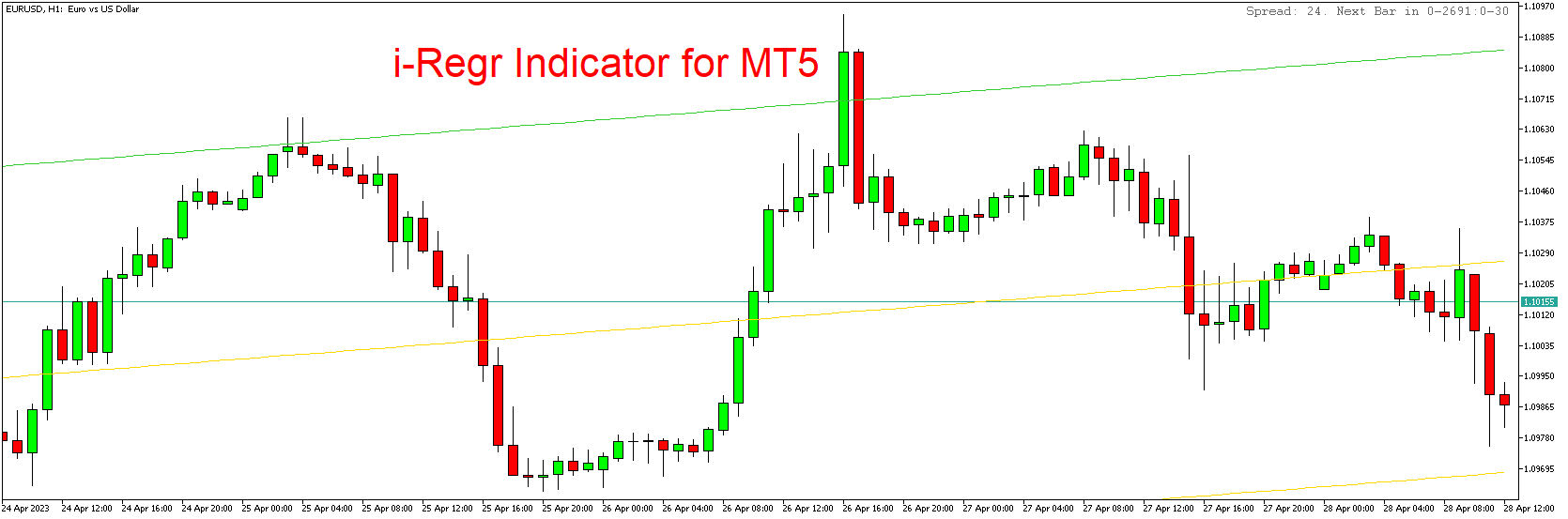

What is the i-Regr Indicator?

The i-Regr Indicator, or the Linear Regression Indicator, is an MT5 technical analysis tool that helps traders identify market trends and potential trend reversals by calculating a linear regression line. The indicator smooths out price fluctuations and provides an objective measure of the trend’s direction and strength.

How Does the i-Regr Indicator Work?

The i-Regr Indicator works by calculating the linear regression line based on the closing prices of a specific period. The linear regression line is a statistical tool that identifies the best-fitting straight line through a set of data points, representing the average relationship between the dependent and independent variables.

Traders can customize the indicator’s settings, such as the period length for the linear regression calculation, to suit their trading style and preferences. Once configured, the indicator will display the linear regression line on the chart, allowing traders to quickly assess the market’s trend direction and strength.

Interpreting the i-Regr Indicator

The i-Regr Indicator provides valuable insights into market conditions, allowing traders to make more informed decisions and adapt their trading strategies accordingly. Here’s how to interpret the indicator:

- Upward Sloping Line: When the linear regression line slopes upwards, it indicates a bullish trend, suggesting that traders should focus on long positions.

- Downward Sloping Line: When the linear regression line slopes downwards, it indicates a bearish trend, suggesting that traders should focus on short positions.

- Horizontal Line: When the linear regression line is horizontal, it indicates a range-bound or sideways market, suggesting that traders should focus on range-trading strategies.

i-Regr Indicator Trading Strategies

Trend-Following Strategies

When the i-Regr Indicator indicates a trending market, traders can employ trend-following strategies, such as using moving averages, trend lines, or momentum indicators to identify potential entry and exit points. By monitoring the linear regression line’s slope, traders can ensure that they are trading in the direction of the trend and avoid getting caught in choppy or range-bound conditions.

Range-Trading Strategies

When the i-Regr Indicator indicates a range-bound or sideways market, traders can employ range-trading strategies, such as buying near support levels and selling near resistance levels. By monitoring the linear regression line’s slope, traders can ensure that they are trading in a range-bound market and avoid getting caught in false breakouts or trend reversals.

Combining the i-Regr Indicator with Other Indicators

For enhanced reliability, traders can use the i-Regr Indicator alongside other technical analysis tools, such as moving averages, oscillators, or support and resistance levels. By combining these insights with their existing trading strategies, traders can improve their overall trading performance.

Conclusion

The i-Regr Indicator is a powerful technical analysis tool designed for traders seeking to identify market trends and potential trend reversals. By understanding its concept, workings, and interpretation, traders can leverage this MT5 indicator to make more informed decisions and adapt their trading strategies accordingly. Download the FREE i-Regr Indicator for MT5 to enhance your market analysis experience today.

Download indicator